RECOMMENDED ACCOUNTING SOFTWARES

Our Services

| Taxation | GST Compliance | Book Keeping |

|---|---|---|

| Tax Returns filing must be easy with us. We provide hassle free service for e-filing of your income tax returns. | GST registrations and returns filing monthly as well as annaully, everything at one place to serve better quality and compliance ranking to the existing laws. | Books of accounts are an important assets of a business, a set of accurate and correct measure or say mirror of the financial position and credibility of any business. |

Follow us:

About the Author:

Amit Shah

Amit has more than 13 years of experience in Direct and Indirect Taxation – Income Tax, GST, Service tax, Excise, Customs, VAT/CST, Tax Audit, Statutory Audits, Trust Audits, TDS/TCS, Company Law, Financial Reporting, Fund Raising, Project Financing matters, etc. and is the founder of Shah Consultancy Service.

Latest Posts:

- Why payments to supplier need to be done within 180 days! GST BIG BITE.

- CG liberalised the import policy of Low Ash Metallurgical Coke

- Opportunity of PH is must even if taxpayers has not filed reply of SCN

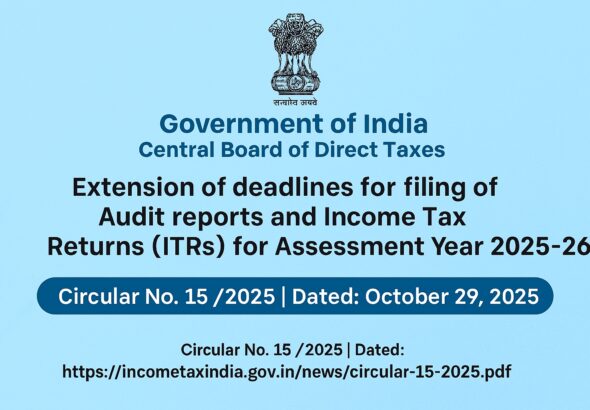

- Extension of timelines for filing of various reports of audit and Income Tax Returns (ITRs) for the Assessment Year 2025-26

- F&O Trading Loss? You Still Need to Report It!

- GST Updates applicable from 1st April 2025

- Advisory for furnishing bank account details by registered taxpayers under Rule 10A of the Central Goods and Services Tax Rules, 2017.

- SPEECH OF INTERIM BUDGET 2024

- The Updated GST Act(s) and Rules(s) – Bare Law, (January – 2024).

- Section 43B(h) : Disallowance of unpaid due of Micro and Small Enterprises